When you look at a stock, the first number you will see is the current price.

#Google finance app how to#

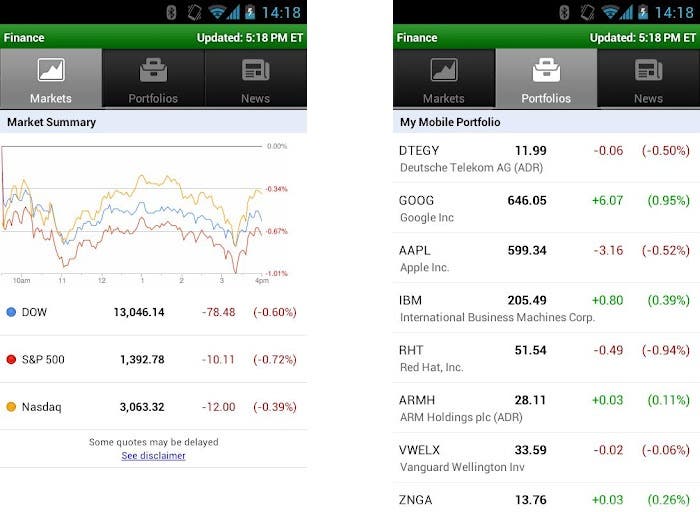

Let’s take a look at the core data Google Finance provides and how to leverage it. Once you get your bearings, you’ll quickly find that it offers all the information and insights you need as you conduct investment-related research. If you are not yet familiar with the platform, setting up your Google Finance portfolio can be a little confusing at first. You also have access to transactions in this mode. View the last price, average volume, market capitalization, 52-week lows and highs, P/E, and earnings per share of each stock. See the price of each stock, its movement, its market capitalization, its volume, and its low and high prices for the day. The are two primary “modes” in which you can use and view Google Finance: Overview There, you can create and name your portfolio, and then begin adding the stocks and mutual funds you would like to track. To get started, go to Google Finance and click on the link labeled “Portfolio” at the top of the page. Once you have secured your account, you can immediately set up your Google Finance portfolio.

#Google finance app free#

This is simple and free to set up - and even easier if you already have a Gmail address. Creating A Stock Portfolio In Google Financeīefore you begin exploring how to use Google Finance, you will first need a Google account. There are many places to get this market news (e.g., online or in newspapers), but Google Finance gives you lots of information in one convenient place. It gives you a terrific overview that you can use to make wise investments moving forward. To do this, you would make a list of what you are thinking about buying next and track it on a “pending” basis.Īdditionally, with the fundamentals tab, you will find important information like the P/E ratio, market cap, and volatility. You can also “bench” stocks on Google Finance. While Google recently removed its old Portfolio tool, it still offers a mechanism that you can import your holdings, and Google Finance will track them for you.Īnd, if you do not want your nosey co-workers to know about your investment in Toys R Us (oops!), you can use the fraction formula to keep your investments confidential, even as you continue to track them at the office. You can find important stock information such as the Price-to-Earnings (P/E) ratio, which is the best indicator as to whether a stock is overpriced. There is a Sector Summary that shows how various industries, such as energy, healthcare, and technology, are doing on a global scale. There is also a Currency section, where you can see how various currencies stack up against one other. This is where you can see how stock markets are doing in other countries. In the Google Finance sidebar, you’ll find a section called World Markets. In addition to having a ton of outstanding information on thousands of companies, Google Finance also has an excellent Portfolio tool. Google Finance is one of the best places to get a large volume of stock quotes and financial news as you explore your various investment options before investing your money.

0 kommentar(er)

0 kommentar(er)